About self storage

The first self storage properties were developed in Texas, US in the mid-1960s. Becoming immediately successful, development of similar self storage properties quickly gained traction throughout the US and Canada. Today facilities are being constructed worldwide.

In the first world markets of the US, Australia and the UK, supply levels are currently estimated at 0.68, 0.15 and 0.05 m² of self storage space per capita, respectively. While the US market is recognised as being some 20 years more mature than the Australian market, the UK self storage sector is much younger than even the Australian sector. Nonetheless, its supply per capita remains almost three times the average supply per capita of 0.015 m² for the greater European market (with the exception of the Netherlands and Sweden which are closer to the UK supply figures).

It is clear that even in more advanced international markets, self storage remains a developing product.

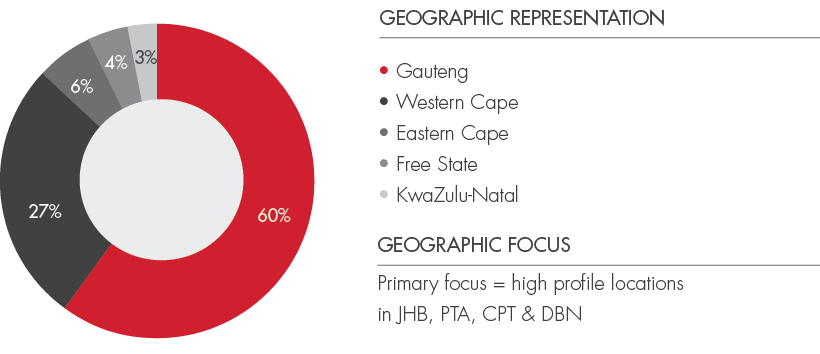

The first self storage properties in South Africa were built in the late 1980s in industrial areas. Local supply in ’first world pockets’ measured in square metres per capita is still low relative to international peers. For smaller operators with limited operational experience, scale and access to finance, the long lead times required to develop a mature ’Big Box’ self storage property in a prime location represent a significant barrier to entry. Therefore while the number of self storage properties in the South African market has increased since 2007, outside of Stor-Age there has been very little growth of well developed, high quality self storage properties in high-end urban and suburban nodes.

Internationally and in South Africa, ownership of self storage properties is highly fragmented compared to the broader commercial property sector. Stor-Age’s view, supported by two market research studies in 2007 and 2014, is that the local industry is currently in the early stages of post ’first round consolidation’. There have been minimal sale transactions over the last 10 years to date. While the fragmented nature of the industry is therefore a source of opportunity, the limited development of investment grade self storage properties outside of Stor-Age (explained above) will pose a challenge.

Demand drivers

Demand for self storage is influenced by socio-economic factors and proximity to demand drivers such as residential development, shopping centres and small business users. Expected future growth drivers include the following trends:

- increasing public awareness of self storage as a service

- smaller living spaces and increasing household numbers

- a shift to apartment living (increase of mixed-use developments – ’live, work and play’) with a resulting reduction in household storage space

- home renovations

- shifting social preferences among ’Millennials’ that are deferring marriage and traditional family formation in favour of maintenance-free lifestyles

- an ageing formerly ’advantaged’ population residing in smaller homes and/or retirement villages

- South Africa’s emerging black middle class

- increased population mobility and urban density

- increased number of online retailers which require flexible storage space

- growth in the number of start-up SMEs requiring flexible and convenient space

Customer profile

Residential users typically use short term storage for life-changing events. However the growing security-driven living trend – estates, apartments and retirement villages – compounded by rising urbanisation, increasing consumerism and access to credit, means that residential users now also have longer term storage demand.

Commercial customers may require storage as a short term measure as they grow or downscale their businesses, or longer term for convenient and secure storage of inventory and archives. We continue to see strong demand from commercial customers across a wide range of industries as they seek a cost effective, flexible solution for their storage requirements, preferring self storage over a traditional long-term lease. Commercial customers generally stay longer than residential customers.

Efficient operations

A mature self storage property generally operates with stabilised occupancy levels in excess of 80%. A new self storage property usually requires between three and five years to lease-up to these levels. The lease-up process begins when a new self storage property is completed and occupancy levels increase incrementally over a period of time to reach the stabilised occupancy target.

Operating expenses are generally fixed in nature and consist predominantly of staff-related costs, utilities such as rates, water and electricity as well as advertising costs. Given this, larger stores in high density urban locations generally drive higher revenues and operating margins. Self storage generally requires low levels of ongoing capital expenditure and maintenance.

MEET ABA

… I really enjoy working for a company that has developed so much over a relatively short space of time.

It’s afforded me the opportunity to not only forge a career path but to learn at the same time.

I am inspired by the amount of value this company places in its people and appreciative of the effort it places into upskilling its staff …

Aba joined Stor-Age as an Assistant Store Operations Manager. Within a year Aba was appointed as our Human Resource Assistant, where she quickly became an integral part of the team. Today Aba is the Assistant HR Manager.

Aba Ayirebi

Assistant HR Manager

PIONEERING THE DEVELOPMENT OF BIG BOX SELF STORAGE PROPERTIES IN South Africa